|

|

How Housing Bubble #2 Bursts June 18, 2025

Corporate / private equity / STVR investors are all fair-weather owners of housing.

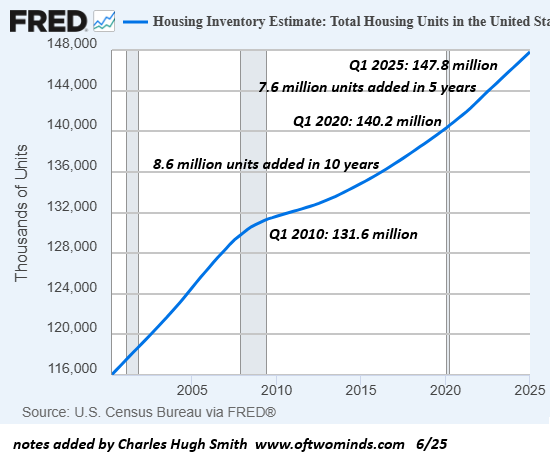

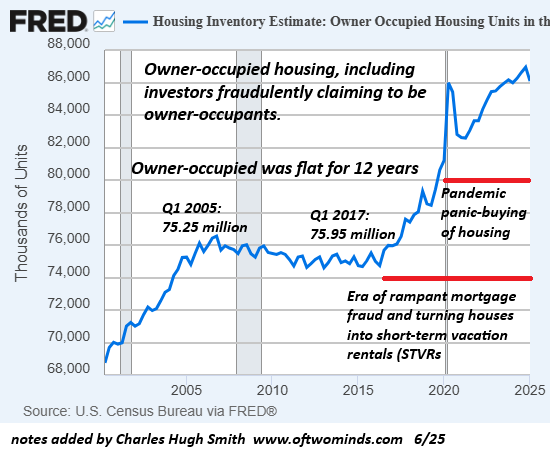

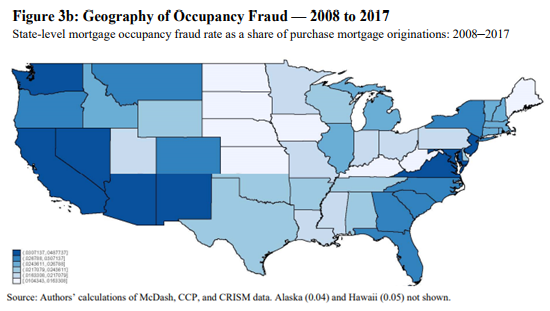

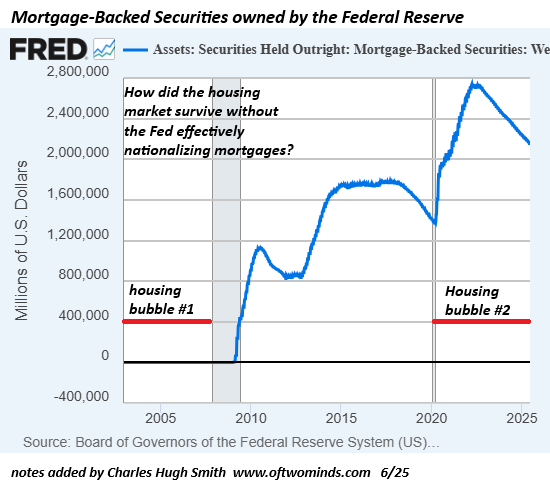

Let's indulge in some basic logic: 1. All credit-asset bubbles burst. 2. U.S. housing is a credit-asset bubble. 3. The U.S. housing bubble will burst. The only variables are how and when Housing Bubble #2 will burst. That's today's topic. I've been writing about housing since 2005, as Housing Bubble #1 was inflating. I've participated in / observed housing rising sharply in the late 1970s and the late 1980s, followed by deflation / stagnation. Housing Bubble #1--circa 2003-2008--was characterized by all the classic signs of a mania: 1. Participants denied it was a bubble. When greed displaces prudence, this isn't a bubble doomed to pop, it's the New Normal. 2. Fraud, malfeasance, misrepresentation, speculation and leverage were all rampant. In the euphoric ascent to ever higher valuations, why let foolish little things like income, risk management and credit ratings stand in the way of reaping more profits? Housing Bubble #2 has rolled over into the decline phase, but this is discounted by the consensus which holds that higher mortgage rates dented the market; once they drop a bit, housing will resume its ascent to ever-higher valuations. I see a different set of dynamics in play: 1. The 40+ year cycle of interest rates / bond yields has turned. Rates will not go back to zero and stay flatlined for years. Risk and inflationary forces have changed and are not returning to The Great Moderation. 2. The Federal Reserve / federal government effectively nationalized the mortgage industry post-2009 Global Financial Meltdown as the means to stop the decline of housing valuations and re-inflate them via super-low mortgage rates. The Fed bought a staggering $1.2 trillion of mortgage-backed securities in 2009-2010, up from zero--a monumental manipulation of the mortgage market that soon exceeded $1.6 trillion. How the housing/mortgage market managed to survive without Fed nationalization prior to 2009 remains a mystery. For its part, the federal government effectively nationalized the quasi-governmental mortgage agencies (Fannie Mae, Freddy Mac), using these agencies to guarantee most mortgages in the U.S. 3. The incentive (lower mortgage rates) to commit fraud by claiming to be an owner-occupant rather than an investor has pushed mortgage fraud to levels that Federal Reserve researchers declare "rampant." Owner-Occupancy Fraud and Mortgage Performance (A 46-page PDF report is available on this link.) The study's authors found that "in most years, fraudulent investors make up roughly one-third of the total pool of investors." Fraud rates in excess of 13% were found in some states states. The frenzy to buy and convert houses to short-term vacation rentals (STVRs) took off in the post-pandemic "revenge travel" boom. Corporate purchases of houses as rental properties had taken off in the post-2009 era of mass foreclosures, a trend that accelerated as private equity sought new markets to exploit. Combine corporate / private-equity buyers with small investors flooding into STVRs and the post-pandemic panic-buying frenzy, and it's little wonder that investors--declared and fraudulent, large and small--now own huge swaths of housing in the U.S.: Investors Bought 26% of the Country's Most Affordable Homes in the Fourth Quarter--the Highest Share on Record An estimated 26% of Fort Worth's single family homes are owned by companies, city says (Yes, family trusts and households can own housing as LLCs, but the study linked above paid no attention to the type of ownership; it paid attention to A) if the owners have multiple first liens, and B) whether they moved following the origination of their new purchase mortgage or not.) 4. The risks created by this preponderance of investor ownership are high. The Federal Reserve researchers found that fraudulent investors pose a much higher risk of default than declared investors and real owner-occupants. As "revenge travel" shrivels up, property taxes and insurance rise and inflation ravages household budgets, STVRs are quickly shifting from income-producing assets to loss-generating liabilities. Investors either sell before they're under-water or the risk of default rises accordingly. Professionally managed corporate and private-equity owners will start unloading properties as rents sag and vacancies rise. STVR owners who realize the tide has reversed will also rush to sell before the price slide gathers momentum. Let's look at some charts for context. Here is a chart of total housing units. Confounding the conventional narrative of a "housing shortage," the U.S. added 7.6 million housing units in the five years 2020-2025, a rate far higher than the 8.6 million units added over 10 years 2010-2020.

Here is a chart of owner-occupied housing. Note that the number of owner-occupied homes was flatlined for 12 years--from 2005 to 2016. Then it suddenly leaps up by 10 million in a few years--from 76 million to 86 million. Did 10 million households all win the lottery, or is the bulk of this astounding increase the result of fraudulent investors posing as owner-occupant buyers?

This map shows the extent of investor mortgage -fraud.

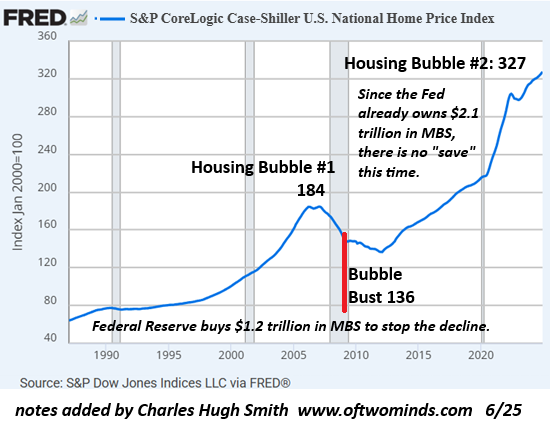

This chart of Federal Reserve ownership of mortgage-backed securities (MBS) overlays neatly with each leap higher in valuations. Pump "free money" into the financial system and keep rates at historic lows, and voila, you can inflate a bubble for the ages.

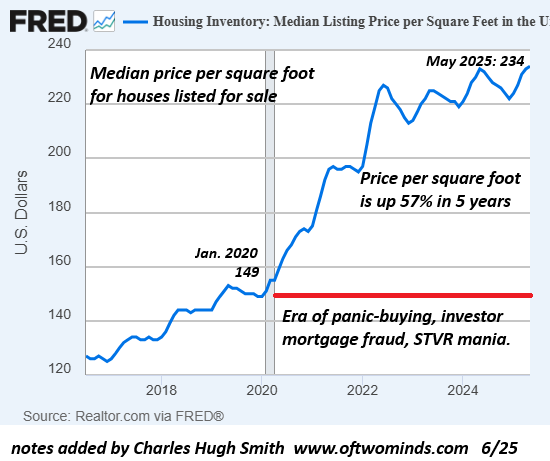

The post-pandemic buying frenzy pushed the cost per square foot of houses listed for sale up 57%.

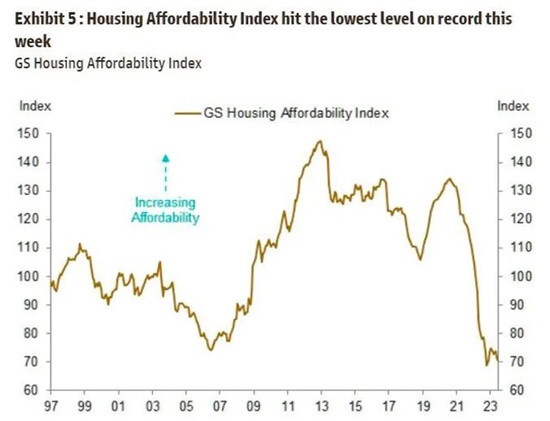

Unsurprisingly, this bubble pushed housing affordability to record lows.

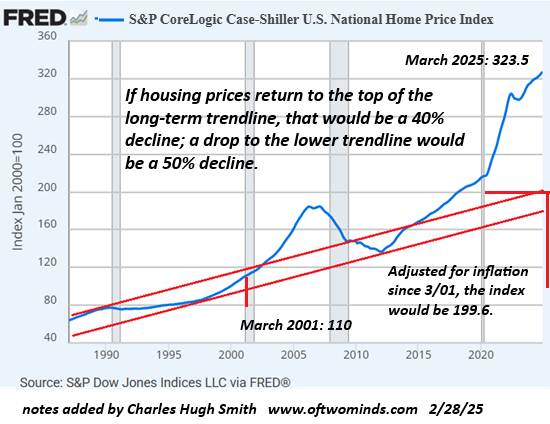

The Case-Shiller Index offers a long-term view of how far valuations could drop once the bubble bursts. A 40% decline would be the norm, and a 50% drop would be well within the typical range of bubbles bursting.

The Fed's mass manipulation of mortgage rates in 2010 "saved" Bubble #1 from playing out in a free-market manner, but the Fed won't be able to engineer an equivalent "save" this time around, as the mortgage market has already been nationalized and the Fed already owns a stupendous $2.1 trillion of MBS.

Corporate / private equity / STVR investors are all fair-weather owners of housing. Once the profits shrink or reverse into losses, investors push the "sell" button. And since housing is priced on the margins, it only takes a handful of get-me-out sales to push valuations down 10%, then 20%, then 30% and eventually to a bottom between 40% anf 50%. This vulnerability to the collapse of valuations is the bitter fruit of the Fed's manipulation of rates and mortgages over the past 16 years. We love a "free market" when rapidly expanding credit inflates a bubble, but oh dearie-dearie me, we have to stop the "free market" from operating if it bursts the bubble. Here's how Housing Bubble #2 bursts: buyers of overvalued, money-losing properties vanish, those who waited too long sink underwater (sales prices are lower than what they paid), marginal investors default, owner-occupants who lose their jobs sell or default, private equity realizes their losses will only increase the longer they hold off selling, and the momentum of sellers far outnumbering buyers cascades. Greed is replaced by fear, and then by the realization it's too late to exit without losses. This is how bubbles burst. Of related interest: Paradise Lost (Melody Wright) My recent books: Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site. The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $18, (Kindle $8.95, Hardcover $24 (215 pages, 2024) Read the Introduction and first chapter for free (PDF) Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF) The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF) When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF) Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF). A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF). Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF). The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF) Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free Become a $3/month patron of my work via patreon.com. Subscribe to my Substack for free The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $20, (Kindle $9.95, Hardcover $24 (215 pages, 2024) audiobook, Read the Introduction and first chapter for free (PDF)  What if growth--and policies to accelerate growth--are no longer working because our fix for every problem--growth at any cost--is failing? We're told Progress is inevitable as a result of technology, but everyday life is getting harder, not easier--the opposite of Progress, what I call Anti-Progress.

What if growth--and policies to accelerate growth--are no longer working because our fix for every problem--growth at any cost--is failing? We're told Progress is inevitable as a result of technology, but everyday life is getting harder, not easier--the opposite of Progress, what I call Anti-Progress.

What if the real source of the unraveling is far deeper than economics or politics? What if the problem is what we see as the inevitable destiny of humanity--Progress--is actually a modern mythology, disconnected from the real-world consequences of growth for growth's sake? We indignantly reject that Progress is a mythology, but our need for mythology hasn't gone away because we've mastered technology; we've created a modern mythology of technology that is heedless of its own consequences. To truly progress, we need a new mythology aligned to 21st century realities. That's the goal of this book. Read the Introduction and first chapter for free Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)  Just as no one was left unaffected by the rise of globalization, no one will be unaffected by its demise.

The only response that reduces our vulnerability is self-reliance: de-risk your life by carving a path that works for you.

Just as no one was left unaffected by the rise of globalization, no one will be unaffected by its demise.

The only response that reduces our vulnerability is self-reliance: de-risk your life by carving a path that works for you.

When Ralph Waldo Emerson wrote his famous essay Self-Reliance in 1841, the economy was localized and households supplied many of their own essentials. Now we're dependent on distant sources for our essentials. For Emerson, self-reliance is thinking for ourselves rather than taking the conventional path. Self-reliance today means reordering our priorities and values. Self-reliance is often confused with self-sufficiency--the equivalent of Thoreau's cabin. But self-reliance isn't about piling up money or an isolated cabin; it's about cooperating with trustworthy others in productive networks. The book details the essential mindset of self-reliance and 18 nuts and bolts principles of self-reliance in the 21st century. Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

Recent entries: How Housing Bubble #2 Bursts June 18, 2025 Good News! AI Can Do More BS Work June 16, 2025 And So It Begins June 13, 2025 Now That the Parasites Have Consumed the Host.... June 11, 2025 The Miracles of Moderate Exercise June 9, 2025 The Ratchet Effect: Easy to Spend More, Spending Less Triggers Collapse June 3, 2025 What AI Can't Do Faster, Better, or Cheaper Than Humans June 2, 2025 My Job Is to Say No--with One Exception May 29, 2025 The "AI Revolution" May Take an Unexpected Turn into the "AI Coup" May 27, 2025 Ours Is a System of Fraud, Swindles and Corruption May 23, 2025

Boomers, Let's Face It: The Math Doesn't Work

May 20, 2025

Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency. All contributors are listed below in acknowledgement of my gratitude.

Of Two Minds Site Links home musings my books archives books/films policies/disclosures social media/search Aphorisms How to Contribute, Subscribe/Unsubscribe sites/blogs of interest original music/songs Get a Job (book) contributors my definition of success why readers donate/subscribe to Of Two Minds mobile site (Blogspot) mobile site (m.oftwominds.com)

HUGE GIANT BIG FAT DISCLAIMER: Nothing on this site should be construed as investment advice or guidance. It is not intended as investment advice or guidance, nor is it offered as such.... (read more) WHY EMAIL TO THIS SITE IS READ BUT MAY NOT BE ACKNOWLEDGED: Regrettably, I am so sorely pressed for time and energy that I am unable to respond to the vast majority of emails. Please know I read all emails, but I can only devote a very limited number of hours to this blog and all correspondence.... Subscriptions to the Weekly Musings Reports Subscribers enable Of Two Minds to post free content. Without your financial support, the free content would disappear for the simple reason that I cannot keep body and soul together on my meager book sales alone. Your financial support is very much appreciated. Subscribers ($7/mo) and those who have contributed $70 or more annually receive weekly exclusive Musings Reports ($70/year is about $1.35 a week). Each weekly Musings Report offers four features: 1. Exclusive essay on an extraordinarily diverse range of insightful topics 2. Summary of the blog this week 3. Best thing that happened to me this week 4. From Left Field (a curated selection of interesting links) There are four easy ways to subscribe: Substack, Patreon, US Mail and Paypal: How to Contribute, Subscribe/Unsubscribe to Of Two Minds What subscribers are saying about the Musings: "What makes you a channel worth paying for? It's actually pretty simple - you possess a clarity of thought that most of us can only dream of, and a perspective that allows you to focus on the truth with laser-like precision." Jim S. Thank you very much for supporting oftwominds.com with your subscription or contribution.

Extra-Special Bonus Aphorisms:

"There is no security on this earth; there is only opportunity." (Douglas MacArthur) "We are what we repeatedly do." (Aristotle) "Do the thing and you shall have the power." (Ralph Waldo Emerson) "Any intelligent fool can make things bigger, more complex, and more violent. It takes a touch of genius and a lot of courage to move in the opposite direction." (E.F. Schumacher, via Tom R.) "He who will not risk cannot win." (John Paul Jones) "When we drink coffee, ideas march in like the army." (Honore de Balzac) "Progress is not possible without deviation." (Frank Zappa, via Richard Metzger) "Victory favors those who take pains." (amat victoria curam) "The man who has a garden and a library has everything." (Cicero, via Lee Bentley) "A healthy homecooked family meal and a home garden are revolutionary acts." (CHS) "Do you know what amazes me more than anything else? The impotence of force to organize anything." (Napoleon Bonaparte) "The way of the Tao is reversal" Or "Reversal is the movement of Tao." (Lao Tzu) "Chance favours the prepared mind." (Louis Pasteur) "Success consists of going from failure to failure without loss of enthusiasm." (Winston Churchill) "Where there is ruin, there is hope for treasures." (Rumi) "The realm of gratitude is boundless." (CHS, 11/25/15) "History doesn't have a reverse gear." (CHS, 12/22/15) Smith's Law of Conservation of Risk: Every sustained action has more than one consequence. Some consequences will appear positive for a time before revealing their destructive nature. Some consequences will be intended, some will not. Some will be foreseeable, some will not. Some will be controllable, some will not. Those that are unforeseen and uncontrollable will trigger waves of other unforeseen and uncontrollable consequences. (July 8, 2014)(thanks to Lew G. for retitling the idea.) Smith's Neofeudalism Principle #1: If the citizenry cannot replace a kleptocratic authoritarian government and/or limit the power of the financial Aristocracy at the ballot box, the nation is a democracy in name only. The Smith Corollary to Metcalfe's Law (The Network Effect): the value of the network is created not just by the number of connected devices/users but by the value of the information and knowledge shared by users in sub-networks and in the entire network. (CHS, 4/6/16) My Credo of Liberation: I no longer care if the power centers of our society--the distant, fortified castles of our financial feudal system--are changed by my actions, for I am liberated by the act of resistance. I am no longer complicit in perpetuating fraudulent feudalism and the pathology of concentrated power. I no longer covet signifiers of membership in the Upper Caste that serves the plutocracy. I am liberated from self-destructive consumerist-State financialization and the delusion that debt servitude and obedience to sociopathological Elites serve my self-interests. (Thank you, Klaus-Peter L., for reminding me) "We've become a culture of excuses rather than solutions: solutions always require sustained effort and discipline." (CHS 4/9/16) "Fraud as a way of life caters an extravagant banquet of consequences." (CHS 4/14/16) "Creativity = problem solving = value creation." (CHS 6/4/16) "Truth is powerful because it is the core dynamic of solving problems." (CHS 7/21/17) "We live in a system of human emotions that masquerades as a science (economics)." (CHS 1/1/18) "Always remember, your focus determines your reality." (George Lucas) "Diversity is for poor people. Sameness is for the successful." (GFB) "When power dissipates suddenly, it dissipates completely." (CHS 7/14/19) "Disobedience is the true foundation of liberty. The obedient must be slaves." (Henry David Thoreau) "Markets cannot price in the value of non-monetized natural assets such as diverse ecosystems." (CHS 7/14/19) "Magical thinking isn't optimism, it is folly." CHS 1/3/22) "Tune in (to self-reliance), drop out (of hyper-consumerism and debt-serfdom) and turn on (to relocalizing capital and agency)." (CHS 1/5/22) "The path to everything you desire starts here: like yourself as you are right now." (CHS 11/20/22) "There are only two signals: how many essentials you produce and share and if you're consuming less with better results. Everything else is noise." (CHS 12/17/22) "Liberation is no longer needing any confirmation or feedback from others or the world for one's sense of self. Wealth, fame, recognition, admiration, praise, prestige, approval, sainthood, martyrdom, success: none are needed, none are desired." (CHS 12/26/22) "When fame, wealth, prestige, status and glory are out of reach, you're free to pursue other more valuable things." (CHS 2/6/22) "It is the sacred duty of every activist who seeks to better their community to grow and share as much life-giving food as is humanly possible." (CHS 6/15/23) "Being anonymous, gray and unknown is the ideal state of freedom." (CHS 3/15/24) "We seem to have entered a world of anti-leisure and anti-productivity in which the unpaid shadow work demanded to keep all the complicated digital bits in motion obliterate our leisure and productivity." CHS (5/22/24) "It is axiomatic that failing systems work the best just before they fail catastrophically." Ray W. "Looking younger is mere technique; thinking younger demands creativity." CHS (10/16/24) "Tell me what's taboo and I'll tell you the truths that threaten the status quo." CHS (12/15/24) "This is the core of the Attention Economy: the ultimate addiction is the addiction to ourselves." CHS (1/28/25) |

|

||||||||||

|

All content, HTML coding, format design, design elements, original images, videos and musical compositions

and recordings on www.oftwominds.com are protected by copyright

© 2025 Charles Hugh Smith, All global rights

reserved in all media, unless otherwise credited or noted.

Terms of Service:

All content on this blog is provided by Trewe LLC for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. These terms and conditions of use are subject to change at anytime and without notice.

Our Use of Generative AI Tools Policy:

Our Privacy Policy:

PRIVACY NOTICE FOR EEA INDIVIDUALS

Notice of Compliance with

The California Consumer Protection Act

Regarding Cookies:

Our Commission Policy:

|

|

|

|||||

| home email me (no promise of response, sorry, here's why) mirror site | |||||